The move to digital is a major change in bookkeeping and accounting, driven by the dedication of virtual assistants equipped for the digital age. By outsourcing bookkeeping tasks, you can avoid the mistakes that often occur when businesses handle their finances. In addition, a virtual assistant can help you keep track of important deadlines and ensure that all of your financial information is up-to-date. Are you expanding at a pace where your in-house team cannot manage bookkeeping? With rising competition, you could lose the edge to market volatility, operating cost, and other hindrances affecting the flow of your business. Keep the quality of your core functions intact by outsourcing virtual assistant bookkeeping services to Express Virtual Assistant.

Chasing Payments:

- Yes Assistant provide a well-organized and flexible virtual assistant service.

- Connect one-on-one with experts so you can manage your books with ease.

- First off, you’re not spending extra on office space, equipment, or utilities since the assistant works remotely.

- VAs input purchase orders, track stock movements, manage cycle counts, and reconcile inventory discrepancies, freeing up the team for strategic analysis and forecasting.

- These professionals are tasked with sending out timely reminders for unpaid invoices, ensuring that clients or customers fulfill their payment obligations.

Their capabilities extend beyond the typical data entry and invoicing tasks to include more complex assignments such as budgeting and forecasting. We’ll also highlight how Insightful’s software to track remote workers can integrate seamlessly into this process. However, virtual assistant bookkeepers use digital tools to manage invoices, track expenses, handle payroll, and prepare financial reports for businesses or individuals.

Insightful helps teams improve productivity!

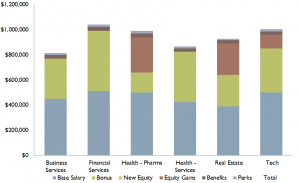

Insourcing offers control and builds internal expertise, but can be expensive. Outsourcing saves money and provides access to specialized skills, but risks quality and control. The best approach depends on your core competencies, budget, and project demands.

Our Clients

A general ledger is of high importance as it is used as a reference point for almost all other financial records. Therefore, attention to detail and an ability to handle large amounts of data are highly desirable skills when it comes to working with a general ledger. A Virtual Bookkeeping virtual assistant is a professional who knows how to do bookkeeping and financial management services online. Delegating financial tasks to a virtual assistant allows business owners to focus on growth and innovation. This shift enables better resource allocation and opens up opportunities for higher returns.

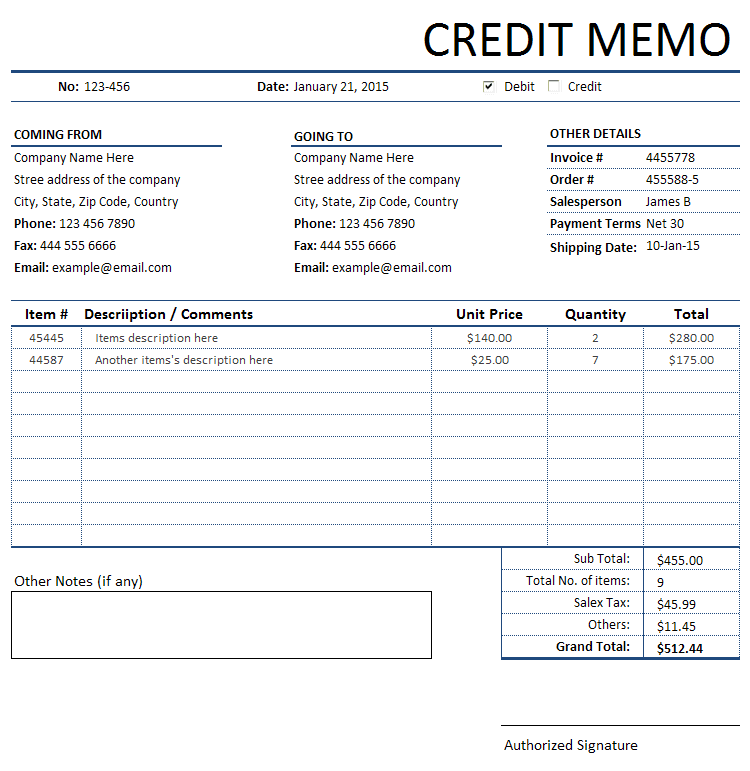

Check the qualifications and skills of service provider

Our virtual assistant bookkeeping experts can help you predict surges and shortfalls in revenue with a complete forecast analysis. Compare recorded financial accounts with external sources and monthly statements with our reconciliation support. Along with processing bills, invoice preparation is an essential skill for any virtual bookkeeping assistant. Busy business owners, after all, do not have the time to dedicate to preparing invoices as their skills are needed elsewhere in the organization. One which involves handling quantities, product data, prices and customer account details. Being able to plan your time here is also vital, as you will often be taking on bulk invoice runs.

It’s like a dream come true, or at least it will be once you find the right one. These virtual assistants are proficient in using Quickbooks, Quicken, Freshbooks, and other relevant accounting software. Financial work is incredibly important and requires full focus to get exactly right.

Since they’re not an employee that you have on contract, you’re not obligated to pay those extra taxes, splurge on benefits, provide space and office supplies, and more. There are multiple parts of a business you’ll need to keep an eye on and actively manage. If you include accounting on your plate of responsibilities, there are bound to be problems with the quality of work. The expectations should be laid out from the start, but they aren’t set in stone. Regular dialogues can ensure that both parties understand what is required and that any changes are communicated clearly. When hiring a Virtual Bookkeeping Assistant (VBA), start by researching and shortlisting candidates through online platforms, reviews, and recommendations.

We have a team of highly skilled and experienced virtual assistants for accounting data entry who cater to your requirements. We employ the latest accounting software and tools to deliver top-notch and error-free accounting data entry services. With over 13 years of experience, Prialto offers highly managed services that take the burden of bookkeeping off your shoulders. At the same time, they don’t need to set up a workplace in the office, buy equipment, and provide transportation and insurance.

Explore how these services can revolutionize your business communication, providing efficiency and professionalism for unparalleled customer interactions. Enhance your business with insights highlighting family members can the best real estate virtual assistant companies. Discover tailored solutions to streamline operations, optimize client interactions, and drive success in the competitive real estate market.

VaVa Virtual Assistants have set themselves apart as a leader in the virtual bookkeeping assistant industry. Instead of simply relying on resumes, VaVa goes beyond the checklist to gauge intangible talents and overall cultural fit. By using DISC personality results, they are able to match each client with a virtual bookkeeper who is not only qualified but also a good fit for their business. https://www.simple-accounting.org/ The Virtual Hub’s virtual assistants are highly skilled and experienced in bookkeeping. They are trained in the latest bookkeeping software and techniques and have a thorough understanding of bookkeeping principles and best practices. In addition to providing top-notch bookkeeping assistance, ClearDesk also offers a variety of management tools and productivity monitoring features.

With a selection process that filters in only the top-tier professionals, businesses gain access to skilled bookkeeping specialists. Outsourcing a virtual assistant for bookkeeping to Stealth Agents allows for significant savings compared to in-house staff, as you pay only for https://www.intuit-payroll.org/employer-payroll-tax-calculator/ the services used. This service allows for efficient and accurate management of financial records without the need for a bookkeeper to be physically in an office. You’ll also notice that there are other intangible benefits for hiring someone to stay on top of your numbers.

They stay updated with the latest industry standards, tools, and regulations, providing you with a service that’s not just competent but cutting-edge. By integrating their skills with your business, you can expect not only to save money but to see a tangible improvement in your financial management. It’s important to have an idea of where the money within a business is at any given moment. And this is why being able to log payables and receivables is such an important skill to grasp.

Hiring a virtual bookkeeping assistant is an excellent option for all sorts of firms, especially for small and medium businesses. This means you’ll have to inform them in advance and book a slot when you need their virtual bookkeeping service. Different virtual bookkeeping assistants specialize in various areas of bookkeeping. Bookkeeping virtual assistants will help you remember to pay the interest for loans, credit cards, and other bills. That’s why seeking virtual assistant services can be the most cost-effective solution.